Retiree's Dream Turned Nightmare: How $450,000 Investment Led to a Sophisticated Scam

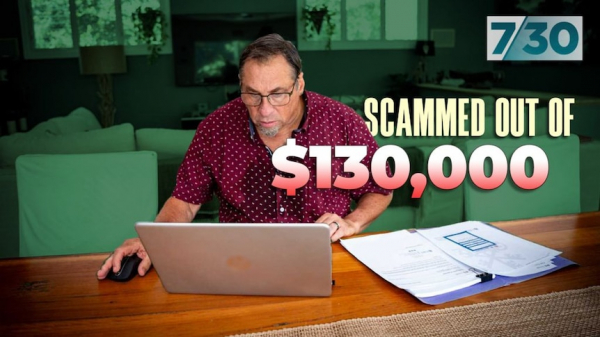

As retirement loomed on the horizon, Peter Correy sought a secure investment to finance his envisioned laid-back lifestyle with his wife, Michelle, along the serene shores of the NSW Central Coast. Opting for the stability of Treasury bonds, he embarked on what he thought would be a straightforward financial endeavor. Little did he know, he was about to fall victim to a sophisticated scam that would shatter his dreams and rattle his sense of security.

After utilizing an online investment comparison platform, Correy was contacted by an individual purporting to represent the renowned Swiss investment bank UBS. Assured by the apparent legitimacy of the transaction, Correy proceeded to invest $450,000 with what he believed to be an established Australian entity, Newtech Industrial Group. However, his optimism soon gave way to suspicion as irregularities began to surface.

Unbeknownst to Correy, the supposed UBS representative was an imposter orchestrating an elaborate scheme. Newtech Industrial Group, though a legitimate entity registered in Australia since 2007, had become unwittingly embroiled in the fraudulent activity. Shockingly, a portion of Correy's investment was surreptitiously diverted offshore by the perpetrators, leaving him emotionally devastated and financially drained.

The revelation of Correy's ordeal sheds light on a troubling trend: Australian companies unwittingly facilitating the laundering of illicit funds. The complexity of these operations presents a formidable challenge for authorities tasked with unraveling the intricate web of culpability. It underscores the urgent need for enhanced regulatory measures to safeguard against exploitation by criminal syndicates preying on unsuspecting victims.

Despite Correy's valiant efforts to seek restitution, only a fraction of his funds were recovered, and Newtech's bank account was promptly closed. However, the saga took a bizarre turn when the directors of Newtech, including the enigmatic Geoff Beaty, a naturopath based on the Gold Coast, and individuals in Europe, reached out to Correy with dubious claims in a desperate bid to salvage their tarnished reputation.

In a surreal twist, the directors attempted to justify their actions, asserting that the offshore transfers were executed in accordance with Correy's wishes. Their dubious explanations only served to compound the confusion surrounding the ordeal, leaving Correy grappling with the unsettling aftermath of a dream turned nightmare.

Unraveling the Web of Deception: Forged Documents and Dubious Claims in Investment Scam

In the aftermath of the investment scam that left Peter Correy reeling, he found himself embroiled in a perplexing maze of deceit and manipulation. As he recounted the bewildering ordeal, Correy revealed the shocking discovery that added another layer of complexity to the already convoluted narrative.

They came back to me, completely dumbfounded as to why we would freeze the account," Correy recounted, reflecting on the baffling response he received when he took action to freeze the compromised account. "They said, 'But we've got all this signed documentation from yourself wanting to invest in Newtech.'

Perplexed by this assertion, Correy was provided with the purported "signed documentation" by Newtech, only to be confronted with a disturbing realization upon scrutiny. The documents, purportedly bearing his signature, were unequivocally forged—a revelation that sent shockwaves through Correy's already shaken confidence.

All using our forged signatures, which they had taken from the passports that we sent through to open the account with UBS," Correy disclosed, exposing the methodical deception employed by the scammers.

To compound the intrigue, Correy was informed by the purported representatives of Newtech that the falsified contracts had been submitted under the guise of being endorsed by the Correy family, orchestrated by a mysterious figure named Marcel Portmann, purportedly operating from the UK as their consultant. However, Correy vehemently denied any knowledge of, or association with, this enigmatic individual.

Among the fabricated documents was a perplexing inclusion—a photograph of the couple's home loan bank statement, a piece of sensitive information that Correy adamantly asserted he never disclosed to the scammers, further deepening the mystery surrounding the elaborate ruse.

In a desperate bid to reclaim his misappropriated funds, Correy found himself ensnared in a web of dubious promises and false assurances. Florin Rozescu, one of Newtech's directors, proffered an audacious proposal, claiming insider connections within INTERPOL, purportedly capable of facilitating the recovery of the lost funds—an assertion met with skepticism given its incredulous nature.

Despite the dubious claims made by Newtech's representatives, Correy remained resolute in his pursuit of justice. However, the company's insistence on his cooperation to unfreeze their bank account added a layer of perplexity to an already confounding saga, leaving Correy bewildered and grappling with the unsettling aftermath of a meticulously orchestrated scam.

Unraveling the Enigma of Newtech: Fabrications, Phantom Offices, and Vanishing Partnerships

The depths of deception surrounding Newtech Industrial Group continue to confound as new revelations shed light on the extent of the elaborate ruse perpetrated by the company. Among the perplexing discoveries is a forged letter purportedly bearing the signatures of Peter and Michelle Correy, meticulously crafted to mimic authenticity by utilizing stolen passport signatures. While the letter accurately reflected the Correys' home address, it contained false contact information, raising questions about its intended purpose and whether similar forgeries were submitted to financial institutions.

In a bid to extricate himself from the tangled web of deceit, Mr. Correy opted to sever communication with Newtech, signaling a decisive stance against further entanglement in their dubious dealings. However, attempts to trace the elusive company's purported global headquarters in Australia proved futile, with an investigative visit to their claimed location on Queensland's Gold Coast yielding no evidence of their presence. Instead, the complex housed incongruous establishments, including a gun shop and the former accounting firm that severed ties with Newtech in early 2023, discrediting the company's assertions of a physical presence.

The facade of Newtech's international success unraveled under scrutiny, with the veracity of their purported achievements across Europe, Asia, and the Middle East called into question. Despite exhaustive inquiries by the ABC, the authenticity of the company's touted partnerships and projects remained elusive, with several entities disavowing any association with Newtech. Assertions of partnerships with reputable organizations, such as Malta Oil and Gas and the Abu Dhabi Investment Authority, were debunked, further eroding the credibility of Newtech's claims.

Compounding suspicions surrounding Newtech are its ties to defunct entities in the United Kingdom and New Zealand, raising red flags about its business practices and integrity. Former partners attested to the company's failure to deliver on contractual obligations, underscoring a pattern of deception and incompetence.

Despite efforts to seek justice, Mr. Correy's quest for restitution hit a roadblock when Queensland Police discontinued their investigation, citing insufficient evidence to pursue charges. Geoff Beaty, one of Newtech's directors, maintained his innocence when approached by authorities, leaving Mr. Correy disillusioned and frustrated by the lack of accountability.

As the intricate web of deceit continues to unravel, the lingering questions surrounding Newtech's operations serve as a cautionary tale of the dangers lurking beneath the veneer of legitimacy, underscoring the need for vigilance in navigating the murky waters of investment opportunities.

Scandal Unveiled: Australian Companies Entrapped in Global Investment Fraud

As the intricacies of the investment scam involving Newtech Industrial Group and its victims continue to unfold, Geoff Beaty, one of the company's directors, offers a terse response when pressed for answers. "We were scammed, he was scammed … there's nothing I can do about it," Beaty asserts before abruptly ending the conversation, leaving a trail of unanswered questions in his wake.

Beaty's evasion underscores the frustration of Peter Correy and others ensnared in the web of deception spun by the perpetrators. Despite attempts to ascertain the details of the scam, Beaty remains tight-lipped, leaving the victims grappling with the aftermath of their financial losses.

In a bid to uncover the intricate network behind the scam, the ABC delves deeper, tracing the path of the misappropriated funds to Hong Kong-based marketing company Prime Networks. Alexandra Savvateeva, Prime Network's owner, acknowledges the association with Newtech but remains bound by a non-disclosure agreement, leaving the nature of their collaboration shrouded in secrecy.

While Queensland Police confirm the fraudulent nature of the scheme, attributing it to an elaborate investment fraud originating overseas, questions linger regarding the extent of Newtech's involvement and the identity of the perpetrators. Despite efforts to seek justice, the matter remains unresolved, with the case filed pending further evidence.

Financial crime expert Neil Jeans raises concerns about the vulnerability of Australia's corporate registry system, with over 3.3 million registered companies susceptible to exploitation by criminal networks. Jeans advocates for greater oversight by the Australian Securities and Investments Commission (ASIC) to curb fraudulent activities perpetrated under the guise of legitimate enterprises.

Despite the damning revelations surrounding Newtech's involvement in the scam, the company continues to operate unabated, raising alarm bells about the efficacy of regulatory measures in combating financial crimes. With foreign-based directors remaining elusive, the pursuit of accountability remains elusive, leaving victims grappling with the fallout of a meticulously orchestrated deception.

Uncovering the Flaws: Challenges in Holding Financial Criminals Accountable

Peter Correy's frustration echoes the sentiments of many victims left in the wake of financial scams— the absence of accountability. "What frustrates me more than someone being arrested is that someone hasn't been made accountable," Correy laments, highlighting the systemic failures that perpetuate impunity in the face of financial crimes.

Correy's disillusionment deepens as he recounts the lackluster response from regulatory authorities. Advised that the Australian Securities and Investments Commission (ASIC) wouldn't take action, Correy's hopes for justice were dashed. Despite being urged to report the incident, he was met with skepticism from law enforcement, further exacerbating the sense of helplessness in combating financial fraud.

ASIC's reluctance to engage further compounds the issue, citing resource constraints and limited jurisdiction as barriers to proactive enforcement. Neil Jeans, a financial crime expert, asserts that while resourcing is a factor, the underlying issue lies in the lack of initiative to tackle financial crimes head-on. He contends that ASIC's inaction inadvertently facilitates the proliferation of fraudulent activities, allowing perpetrators to exploit legal entities for illicit gains.

The Newtech case represents a broader trend of legitimate Australian companies unwittingly becoming conduits for financial crimes—a phenomenon exacerbated by the global prevalence of money mules. Australia's financial watchdog, AUSTRAC, warns of the active exploitation of vulnerabilities within the banking system by criminals seeking to launder illicit funds, underscoring the urgent need for regulatory intervention.

Despite the global nature of the problem, Australia's response to money laundering remains inadequate, with persistent shortcomings in compliance with international standards set by organizations like the Financial Action Task Force (FATF). Neil Jeans emphasizes the critical need for Australia to address these deficiencies, lest they continue to serve as loopholes exploited by criminal networks to perpetrate financial crimes with impunity.

As victims grapple with the devastating consequences of financial scams, the imperative for regulatory reform and enhanced enforcement measures becomes increasingly apparent. Only through concerted efforts to close regulatory gaps and hold perpetrators accountable can Australia hope to stem the tide of financial crime and safeguard the integrity of its financial system.

Systemic Flaws Exposed: Australia's Struggle with Anti-Money Laundering Regulations

Australia's current Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) framework has come under scrutiny for its glaring omissions, particularly concerning the lack of reporting requirements for lawyers and accountants involved in processing company paperwork. Neil Jeans, a financial crime expert, highlights Australia's outlier status in neglecting this crucial aspect of regulation, lamenting, "We are one of very few countries in the world that basically have not introduced this. It's a pretty bad fail.

Despite pledges from the Australian government to rectify these deficiencies, progress has been sluggish amid anticipated resistance from the affected professions. Meanwhile, cases like Jenny's serve as poignant reminders of the urgent need for regulatory reform. In her harrowing ordeal, scammers manipulated technology to siphon $300,000 from her account within a mere four-hour window, underscoring the devastating consequences of inadequate safeguards.

Attorney General Mark Dreyfus has sounded the alarm about the potential repercussions if Australia fails to bolster its anti-money laundering efforts, warning of the possibility of being "grey listed" by the Financial Action Task Force (FATF), a move that could have detrimental effects on the country's economy. FATF's recent report criticizing Australia for failing to meet key obligations further underscores the urgency of the situation.

Chris Sheehan, NAB's head of fraud, emphasizes the evolving nature of financial crime, stressing the need for legislative and regulatory frameworks to adapt accordingly. However, for victims like Peter and Michelle Correy, the ramifications of systemic failures are dire. Peter expresses frustration at Australian companies unwittingly becoming conduits for illicit funds, lamenting, "I find it annoying and quite devastating that Australian companies are out there as means for channelling money overseas … it's horrendous that this can happen.

As Australia grapples with the repercussions of its lax regulatory environment, the imperative for comprehensive reforms to combat money laundering and safeguard the financial system has never been more pressing. Failure to address these shortcomings risks not only the integrity of Australia's economy but also the livelihoods of countless individuals vulnerable to exploitation by sophisticated criminal networks.

In conclusion, Australia finds itself at a critical juncture in its efforts to combat money laundering and enhance its anti-financial crime measures. The deficiencies within the current AML/CTF framework, particularly the lack of reporting requirements for key professionals like lawyers and accountants, have left gaping loopholes exploited by criminals with devastating consequences for individuals and the economy as a whole.

While there is recognition at the governmental level of the urgent need for reform, progress has been slow and resistance from affected sectors looms large. However, the recent warnings from international bodies like FATF underscore the severity of the situation and the potential ramifications of inaction.

As cases of financial fraud continue to emerge, such as Jenny's heart-wrenching ordeal, and victims like Peter and Michelle Correy grapple with the aftermath of systemic failures, the imperative for comprehensive regulatory reform becomes increasingly apparent. Australia must heed the call for change, bolstering its regulatory mechanisms, and closing the loopholes that enable criminal exploitation.

Only through concerted efforts to strengthen anti-money laundering practices, enhance regulatory oversight, and foster collaboration between government, financial institutions, and law enforcement agencies can Australia hope to effectively combat financial crime and safeguard the integrity of its financial system for the future.